Environmental, social, and governance (ESG) concerns are crucial issues that businesses must address to maintain their long-term sustainability. They are no longer merely trendy buzzwords in the corporate world. Investors, consumers, and other stakeholders are becoming more and more aware of the significance of ESG factors and are pressing businesses to be more open and accountable. As a result, for businesses that wish to succeed in the present business environment, integrating ESG thinking across the corporate plan has become essential.

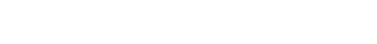

ESG is a group of non-financial factors that are used to judge how well a company is doing and how sustainable it is. Environmental factors look at how a company’s activities affect the natural environment. This includes things like carbon emissions, waste handling, and the use of upward resources. Social factors encompass the manner in which a company engages with its workforce, clientele, vendors, and local populace, in addition to challenges such as diversity, equity, and inclusion. Governance factors pertain to the internal management systems of a company, encompassing the board of directors, executive compensation, and the transparency of financial reporting.

ESG vs Company Goals:

Integrating ESG thinking into the business strategy means putting ESG factors into every part of a company’s operations, from making decisions to evaluating success. It takes a change in mindset from seeing ESG factors as separate from the business strategy to seeing their importance as key drivers of long-term value creation. It is imperative for companies to prioritize Environmental, Social, and Governance (ESG) issues, ensure their alignment with overall business objectives, and maintain transparent communication with stakeholders regarding their advancements in this regard.

What is the key to sustainable success?

As we progress from compliance to efficiency to innovation and growth, the pattern implies that market demand is significantly influenced by climate change, diversity, customer access to and affordability of products, and so on. There are various reasons why organizations should incorporate ESG thinking into their business strategy. First and foremost, it is critical for long-term sustainability. Companies that fail to handle ESG issues risk damaging their reputation, facing legal and regulatory hurdles, and experiencing financial instability. This can lead to a loss of trust among stakeholders, affecting the company’s bottom line.

Source: Public Sentiment and the Price of Corporate Sustainability

Second, incorporating ESG considerations can increase innovation and productivity. By prioritizing ESG concerns, businesses can uncover new development opportunities and establish more sustainable and effective business models. Organizations have the potential to diminish their carbon emissions by engaging in practices such as allocating resources towards renewable energy or integrating sustainable procedures within their supply chain operations. Companies have the potential to mitigate their ecological footprint and achieve long-term financial savings.

Thirdly, integrating ESG principles can help businesses attract and retain top talent. In today’s workforce, employees prioritize organizations that share their values and demonstrate a commitment to social and environmental responsibility. Companies that prioritize ESG factors can create a workplace that is more inclusive and diverse, cultivate a culture of innovation and collaboration, and recruit and retain top talent.

Lastly, ESG thinking can assist businesses in strengthening their relationships with their stakeholders. By promoting transparency and accountability, businesses can inspire confidence in investors, customers, suppliers, and the community. This can lead to increased brand loyalty, an improved reputation, and, ultimately, long-term value creation.

Barriers to Sustainable Success:

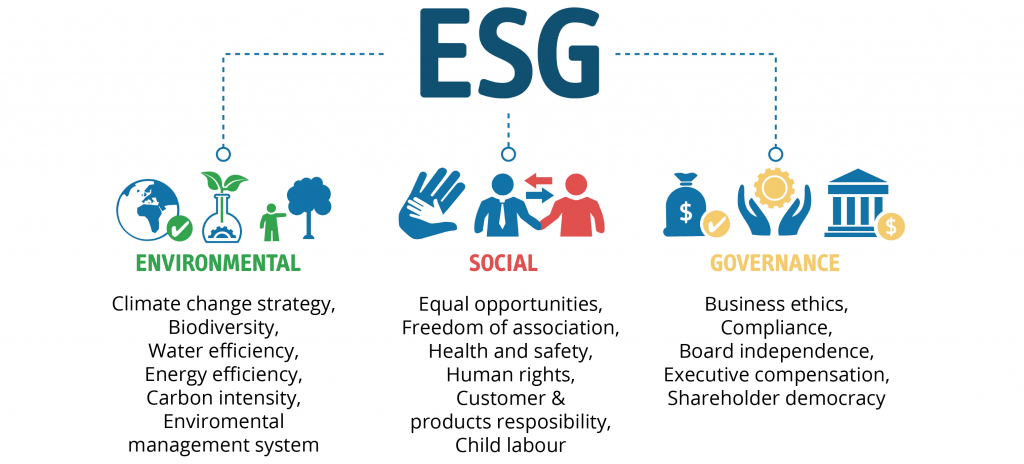

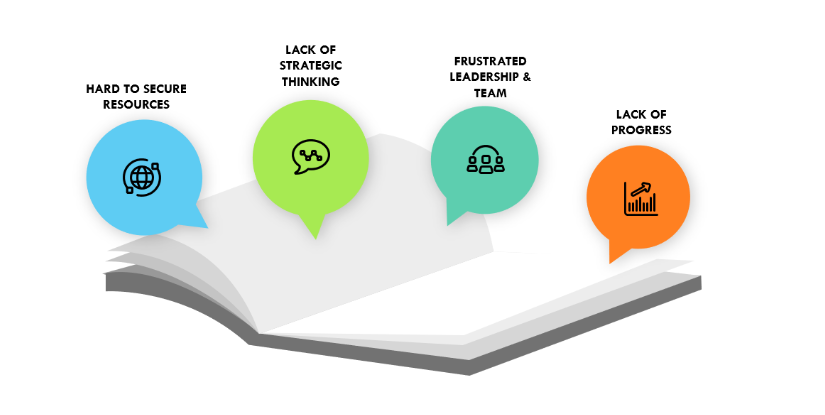

The bulk of sustainability projects prioritize environmental and social goals. But, as deadlines approach, how do businesses go from well-intentioned goals to actual accomplishment?

To be successful, the ‘gap’ between intention (objective) and achievement (real impact) must be closed. Integrating ESG issues into company planning, however, is not without challenges. One of the most significant barriers is the lack of defined measurements and reporting systems for ESG problems.

Source: Author’s Own

Despite the existence of several frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), the reporting of ESG factors exhibits inconsistencies and challenges in terms of comparability. The aforementioned circumstance poses a challenge for enterprises in establishing performance benchmarks and for stakeholders in conducting comparative analysis of companies’ ESG performance.

Another problem is the requirement for cultural transformation inside organizations. Integrating ESG thinking necessitates a mental shift from considering ESG variables as distinct from business strategy to recognizing their significance as important drivers of long-term value development. This necessitates a culture shift within businesses, which can be difficult to achieve.

The Cost of Overlooking ESG: Why Businesses Must Act Now

Despite these obstacles, businesses cannot afford to overlook ESG issues. Because of the increased demand for openness and accountability from stakeholders such as investors, regulators, and consumers, businesses must adopt a proactive approach to ESG concerns. This demands senior leadership commitment, a clear understanding of the business case for ESG, and a willingness to invest in the resources and tools required to integrate ESG thinking across the business plan.

Adopting a sustainable framework, such as the United Nations Sustainable Development Goals (SDGs), is one approach to incorporating ESG thinking into the business strategy. The SDGs provide a comprehensive and widely recognized framework for sustainable development that addresses a variety of ESG concerns such as climate action, social and economic development, and responsible consumption and production. Companies may ensure that they are tackling a wide variety of ESG concerns and contributing to the attainment of global sustainability goals by aligning their business strategy with the SDGs.

In conclusion, businesses that want to ensure their long-term sustainability and generate value for all stakeholders must incorporate ESG thinking into the whole company plan. To integrate ESG issues into every facet of a company’s operations, top leadership must make a mental change and the organization must be ready to invest in the appropriate tools and procedures. Even though integrating ESG thinking presents obstacles, businesses in today’s market cannot afford to disregard these pressing problems. Companies can build a more sustainable, inventive, and inclusive future for everyone by giving ESG issues priority.